January Inflation Edges Up to 2.75% as New CPI Series Takes Effect

India retail inflation January 2026 quickened to 2.75% in January as prices of food items and precious metals rose, data based on a new series showed Thursday (February 12), returning to the RBI’s target band after three months.

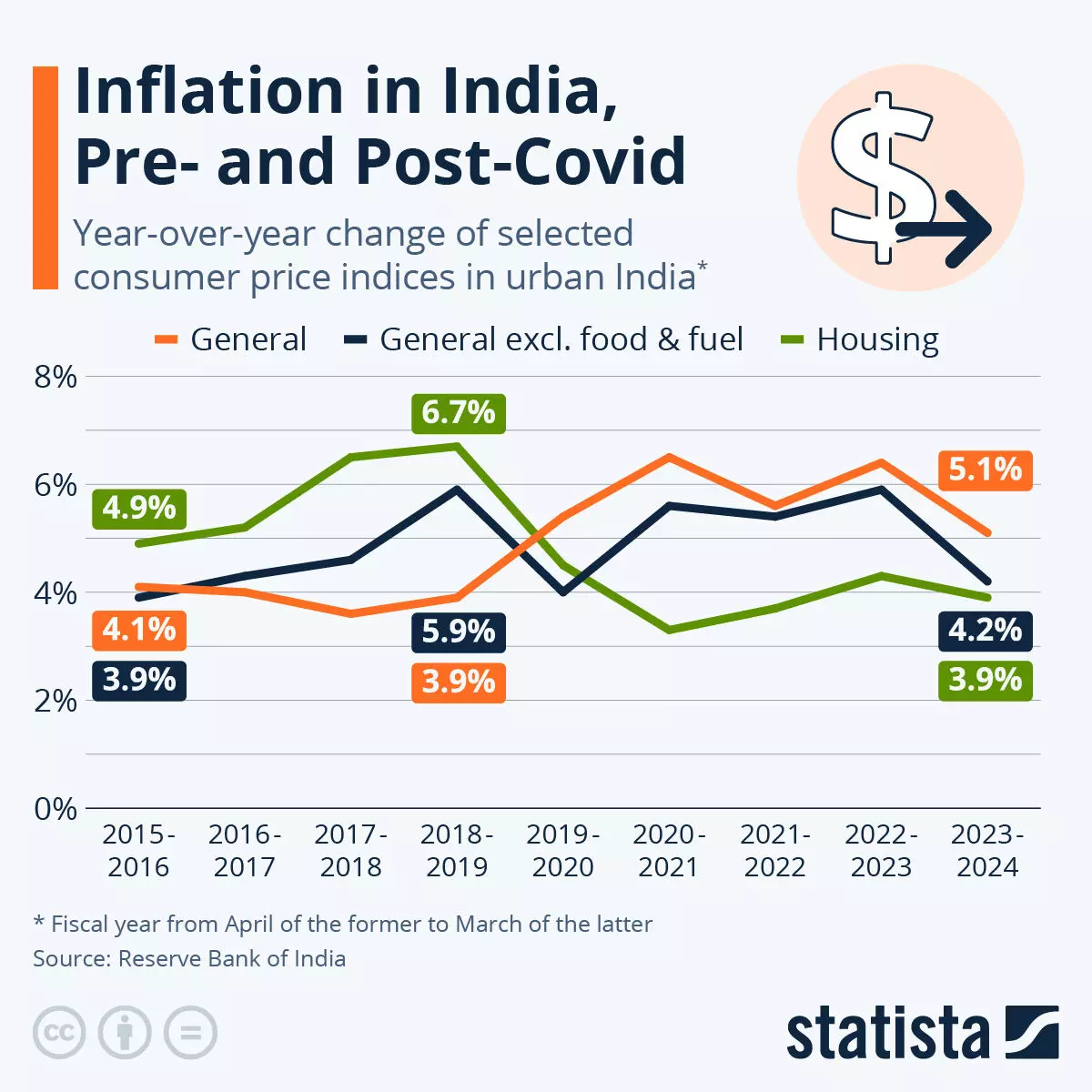

India’s retail inflation under the new 2024-base Consumer Price Index stood at 2.8% in January, marking the first print after revised weightings for food, housing, and modern consumption items.

This is the first print since India moved to the new Consumer Price Index data series with

changed weighting for key components such as food and housing and a new base year of 2024.

Retail inflation measured using consumer price index (CPI) stood at 2.8% in Jan under the new

series, according to data released by the National Statistics Office (NSO). Food inflation

quickened to 2.1% in Jan. While rural inflation print was lower at 2.7% as compared to urban

inflation at 2.8%. India’s CPI-based retail inflation under the old series was at 1.3% in Dec 2025.

Personal care, social protection and miscellaneous goods which include gold and silver

jewellery, saw CPI inflation 2.75% India surge 19% in Jan. Silver jewellery inflation raced to

160% during the month.

The old series used weights as of 2012 which assigned a very high weight to food. Several

policymakers had often bemoaned the index’s volatility due to high food weight. Food articles

continue to be the largest constituent of the new CPI series 2024 base year as well.

“The number of items covered has increased from 299 to 358 in the new series. The goods items

have increased from 259 to 308 and services from 40 to 50.

“Inclusion of rural house rent, for the first time, improves the coverage of housing consumption

in rural areas. Strengthened representation of modern consumption items has also been done, for

example, online media services and fuels like CNG and PNG,” it added.